Gold

(471 products)Sort by

Default

Filters

Metal Type

Gold (471)

Silver (269)

Platinum (25)

Palladium (7)

Product Family

Bullion (234)

Collectible (155)

Numismatic (93)

Product Type

Cast bars (14)

Minted bars (146)

Coins (309)

Rounds

Monster Box (2)

Tubes

Collections

PAMP Cast Bars (6)

PAMP Lady Fortuna (17)

PAMP Rosa (8)

PAMP Collectibles (40)

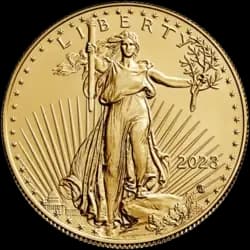

American Eagle (18)

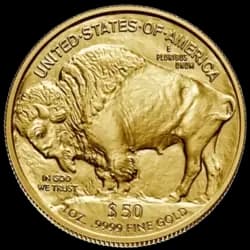

American Buffalo (4)

Austerlitz (3)

Australian Emu (1)

Austrian Corona (1)

Batman

Big Five

Bitcoin (1)

Black Flag

Britannia (16)

Coca Cola

Christmas Collectibles (4)

Crypto (1)

Czech Lion (4)

Disney (3)

Diwali (5)

Dragon (3)

Elephant (6)

Falcon

Franc a Cheval (4)

Gifts & Collectibles (9)

Gold to Gift (14)

Graded Coins (6)

Kangaroo (17)

Koala

Kookaburra

Krugerrand (12)

Licensed Products (3)

Louis d'Or (4)

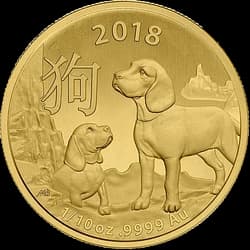

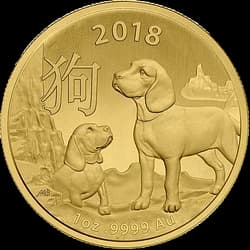

Lunar (52)

Maltese Cross (4)

Maple Leaf (25)

Mexico Libertad (4)

Myths and Legends

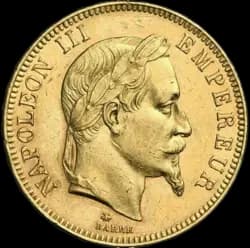

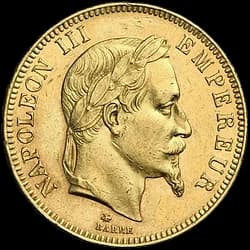

Napoleon (21)

Noah's Ark (8)

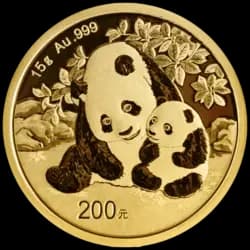

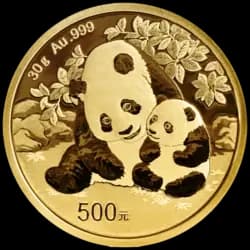

Panda (8)

Philharmonic (21)

Silver to Gift

Sovereign (10)

Spanish Doubloon (8)

Star of David (1)

Star Wars (1)

Swan (3)

Swiss Heritage

Unesco (3)

Vreneli (26)

CGT-Free (UK only) (25)

View more

Product Selection

Deals (8)

Auto-Savings (49)

Limited Editions (46)

New Arrivals (15)

Bestsellers (9)

Price

< €50.00

€50.00 - €250.00 (28)

€250.00 - €500.00 (54)

€500.00 - €1,000.00 (128)

€1,000.00 - €2,000.00 (82)

€2,000.00 - €5,000.00 (136)

€5,000.00 - €∞ (43)

Weight

1 gram (22)

< 1/10 oz (3.11 grams) (40)

1/10 oz (3.11 grams) (43)

5 grams (52)

6 grams - 9 grams (101)

10 grams (18)

20 grams (8)

11 grams - 30 grams (62)

1 oz (31.10 grams) (106)

50 grams (7)

100 grams (17)

250 grams (2)

10 oz

500 grams (3)

1 kilo (4)

100 oz

5 kilograms

15 kilograms

View more

Brands

Allcollect (2)

Argor-Heraeus (10)

Austrian Mint (22)

Bavarian Mint (3)

C.Hafner (3)

China Gold Incorporation (8)

Cuban coins (1)

Czech Mint (4)

Geiger Edelmetalle (8)

German Mint (5)

Gold Avenue (1)

Heimerle+Meule (2)

Heraeus (13)

Italian State Mint (3)

MDM (3)

Mexican Mint (5)

Monnaie de Paris (40)

PAMP Suisse (116)

Perth Mint (40)

Pressburg Mint (4)

Random Mint (13)

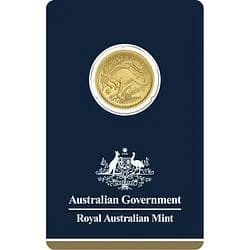

Royal Australian Mint (7)

Royal Canadian Mint (26)

Royal Dutch Mint (4)

The Royal Mint (26)

Royal Mint of Belgium (1)

Royal Danish Mint (1)

Royal Mint of Spain (8)

South African Mint (15)

Swissmint (28)

Umicore (2)

US Mint (30)

9Fine Mint (15)

View more